With increasing property prices, we understand that not everyone can afford to buy a home outright. If you’re in this situation, then you might be able to buy a new home through shared ownership.

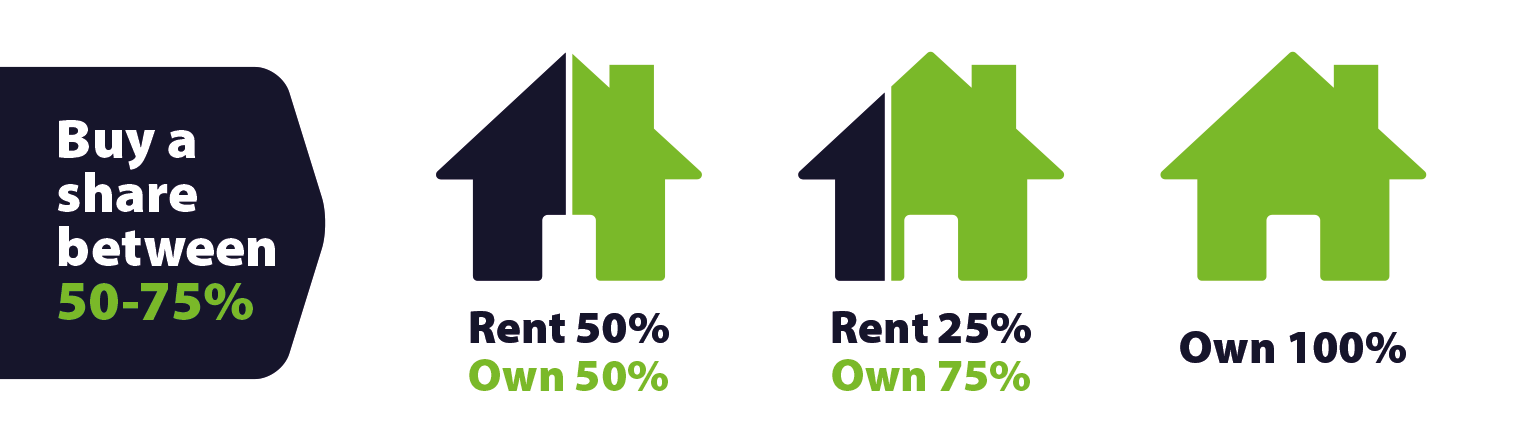

With shared ownership, you buy a percentage of your home and pay rent on the rest. This means your mortgage will be less and you won’t have to find a big deposit.

Who’s eligible for shared ownership?

You could be eligible to buy using shared ownership if:

- Your household income is £80,000 a year or less

- You are a first time buyer

- You previously owned a home and can’t afford to purchase a property outright

- You are returning to the property market, for example, after a relationship breakdown

- If you are living in a current shared ownership property then the property must be sold

- You must pass a financial assessment, proving financial capability to buy the minimum share value and monthly payments

- You have a deposit of at least 5% of the share-value of the home

Part mortgage/part rent – how does that work?

Shared ownership is part buy, part rent. This means you’ll have a mortgage on the share you own, and pay rent on the remaining share. For example, if you buy a 40 percent share in the property, you'll pay a mortgage on the 40 percent, and rent on the remaining 60 percent. Usually, you can carry on buying shares until you own the property 100 percent.

What are the benefits?

• You need a smaller mortgage and a smaller deposit

• You get the home that you have always dreamed of at a price that is affordable

• You can buy more shares in your home, when you can afford to

Will I be classed as a homeowner?

When you buy a shared ownership property, you become a homeowner and you’ll take on all the responsibilities, and the benefits, that go with owning a home. Shared ownership doesn't mean that you have to share your home with anyone else.

You’ll begin by buying a part of your home under a lease, which is essentially the contract for the share you've bought. It means you've got the right to keep your home for the full term of the lease, which is 990 years. The lease sets out:

- Your rights and responsibilities as a homeowner

- How often your rent and service charge are reviewed

- What you can expect from us

You’ll be a leaseholder and Your Housing Group will be the landlord, but you’ll have the same rights as a homeowner.

Can I buy more shares?

You have the option to buy further shares at the property’s market value. This is known as staircasing. The more shares you buy, the less rent you'll pay. Once you’ve staircased to 100 percent, you’ll no longer pay rent and you’ll own your home outright.

If you're buying an apartment, there would still be a service charge and management fee to pay.

Please speak to our sales team for more information on staircasing.

How do I apply?

Visit our developments page and find your dream home. Once you have found a home you must check you are shared ownership eligible online. Please apply at Shared ownership homes: buying, improving and selling: Apply - GOV.UK (www.gov.uk).

To confirm you meet the shared ownership eligibility criteria, please complete our on-line application form if you want to apply to buy a shared ownership home, once completed, we will be able to review your application. The application form can be found here.

Before submitting your form, please read the Standard Shared Ownership Key Information Documents below:

- Affordability & Minimum Monthly Income Surplus Policy

- First Come First Served Policy

- Cash Buyer Policy

- Adverse Policy

- Minimum Deposit Policy

By submitting the form you agree you have read and accept the Standard Shared Ownership Key Information Documents which can be read here.

If you are eligible for shared ownership, you will be required to complete a financial assessment with our recommended Regulated Mortgage Provider to confirm you are financially eligible to proceed.

Our homes are reserved on a first come first served basis and Your Housing Group reservation fee is £350. YHG Sales Team will support you through the process.

Once you have completed your full affordability assessment, determined the share purchase and maximum mortgage available and we have received from the Mortgage Provider the sign off sheet completed and signed by the relevant parties, your application will be submitted to the Home Ownership Team who will contact you to carry out their approval, this will be conducted over the phone.

As well as assessing your application they will go through the Shared Ownership Key Information Document, lease obligations, terms and conditions which can be found here.

Once you have been approved, we will call you to pay your £350 reservation fee and request your solicitor details. The reservation fee will be deducted from the final completion monies.

Solicitors will be formally instructed. YHG can provide you with a list of solicitors who specialise in shared ownership to assist you with a smoother conveyancing process. The Memorandum of sale and Homes England Key Information Documents will be issued to our solicitor who will issue the legal paperwork to your solicitor.

It is your responsibility to keep in touch with your solicitor to ensure they are working towards the deadline. We will require to see sight of your mortgage offer for approval (if applicable). Your solicitors will carry out searches and raise enquiries via our solicitors. Should you have any queries, please contact your allocated Property Sales & Conveyancing Officer.

Once the solicitors have carried out their searches and the offer has been approved and an exchange date will be set. You will have the opportunity to view your property between exchange and completion.

On completion you will be expected to pay an apportion of the rent and service charge from the date of completion until the end of the month plus a further one month’s charge. Once the solicitors have confirmed that completion has taken place the keys will be released.

Your YHG Sales Advisor will meet you at your brand new home to hand over your keys.

Shared ownership application form

Don't forget to complete your shared ownership application form here once you've found your dream home!